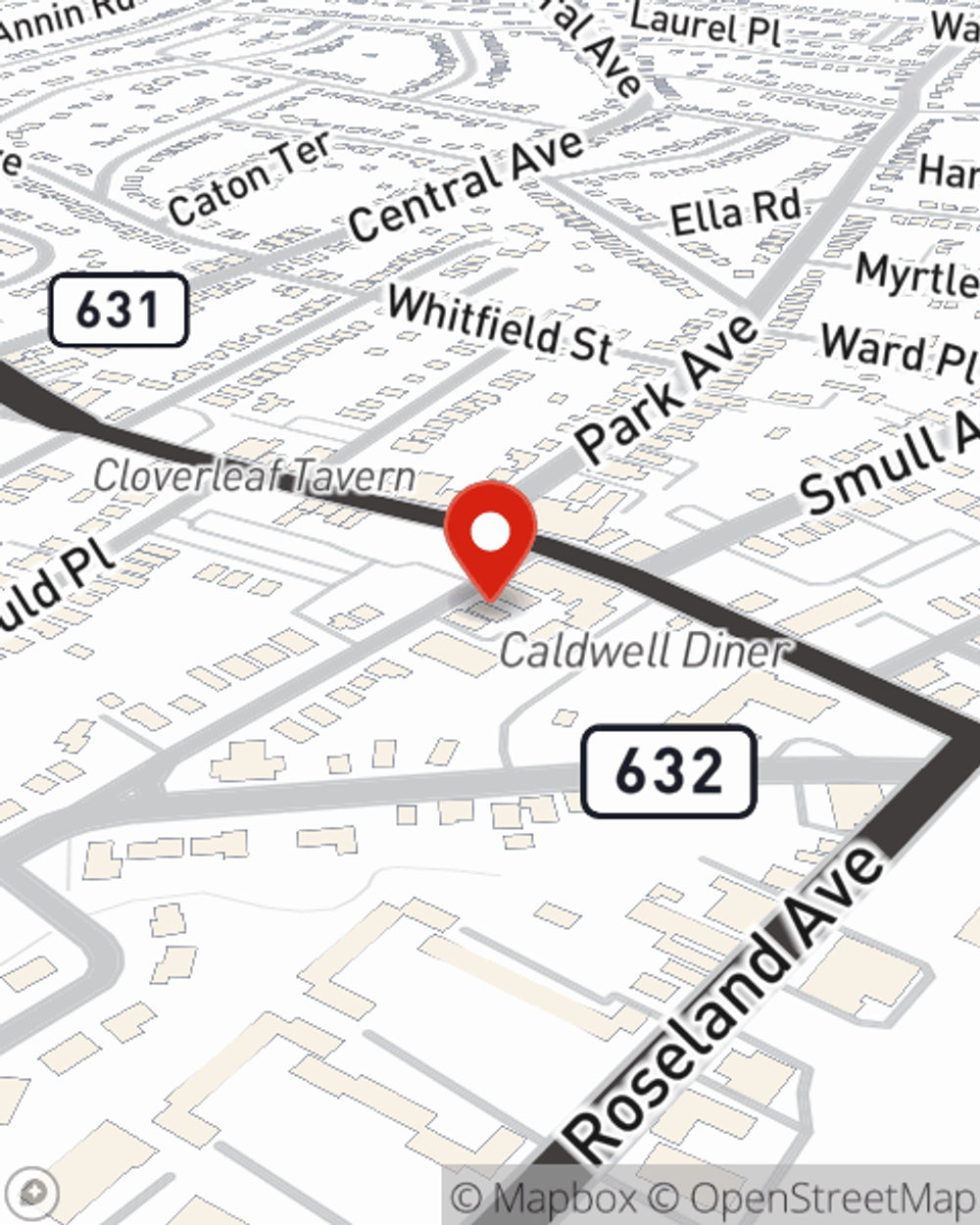

Condo Insurance in and around Caldwell

Caldwell! Look no further for condo insurance

Cover your home, wisely

- Caldwell

- Perth Amboy

- Roseland

- Verona

- West Caldwell

- Bloomfield

- Mont Clair

- Dover

- Hackensack

- Paterson

- Vineland

- Pleasantville

- Ossining

- Newark

- Mamaroneck

- Jersey City

- Fairfield

- Elizabeth

- Camden

- Trenton

- Union City

- West New York

- New Rochelle

- Ridgewood

Condo Sweet Condo Starts With State Farm

When it's time to take it easy, the home that comes to mind for you and your family and friendsis your condo.

Caldwell! Look no further for condo insurance

Cover your home, wisely

Agent Carlos Capellan, At Your Service

We know how you feel. That's why State Farm offers great Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Carlos Capellan is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that works for you.

Ready to move forward? Agent Carlos Capellan is also ready to help you discover what customizable condo insurance options work well for you. Get in touch today!

Have More Questions About Condo Unitowners Insurance?

Call Carlos at (973) 226-7422 or visit our FAQ page.

Simple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Carlos Capellan

State Farm® Insurance AgentSimple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.